- English

- Arabic

In This Blog Post

Share This Article

- Published: Dec 26, 2025

- Last Updated: Dec 26, 2025

- 🔊 Listen

Quick Reads

- Microsoft Dynamics 365 unifies finance, operations, and reporting into one connected system, eliminating fragmented tools.

- UAE businesses gain real-time visibility into cash flow, performance, and working capital for faster decisions.

- Built-in VAT handling supports UAE compliance, cleaner audits, and stress-free filing cycles.

- Cloud-based scalability allows easy expansion across Emirates, free zones, and global entities.

- Automation reduces manual finance work, improves accuracy, and delivers long-term ROI as businesses grow.

Accounting teams in the UAE deal with more than routine bookkeeping. VAT compliance, multi-currency transactions, cross-border operations, and real-time reporting are everyday realities. This is where MS Dynamics accounting software stands out as a practical accounting solution for growing businesses in the region. Microsoft Dynamics brings finance, compliance, and reporting into one connected system, giving UAE businesses clearer control over their numbers without adding complexity.

With MS Dynamics for accounting, organisations gain accurate financial visibility, built-in VAT handling aligned with UAE regulations, and the flexibility to scale as operations expand across the GCC or globally. From automating core accounting processes to supporting strategic financial decisions, MS Dynamics helps UAE businesses move beyond manual work and fragmented systems and operate with confidence, speed, and compliance.

MS Dynamics, Refined

Automation Aligned With Your Accounting Strategy

Top 10 Benefits of Using MS Dynamics 365

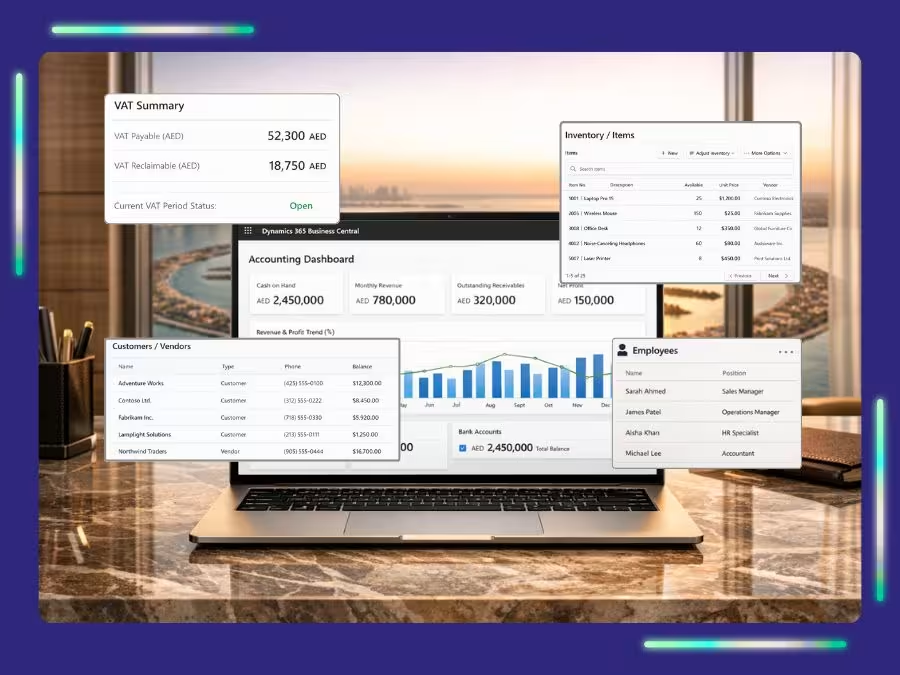

Microsoft Dynamics 365 is not just an accounting or ERP system for UAE businesses. It acts as a central control layer, bringing structure, visibility, compliance, and scalability together. For organisations dealing with growth, regulatory pressure, and operational complexity, it shifts finance from a support function to a strategic driver.

1. One Connected System for the Entire Business

Microsoft Dynamics 365 brings finance, sales, operations, supply chain, and customer management into a single ecosystem. Instead of juggling multiple tools, teams work from one shared platform where data flows automatically across departments. For UAE businesses managing mainland entities, free-zone companies, or overseas branches, this unified structure makes inter-company transactions and consolidated reporting far more accurate and controllable.

2. Clear, Real-Time Financial and Operational Visibility

Dynamics 365 provides live dashboards that show what’s happening across the business. Leadership gets instant access to cash flow, receivables, payables, inventory, and performance metrics. In the UAE’s fast-moving market, real-time visibility supports quicker decisions around cash flow, VAT obligations, and short payment cycles; helping businesses protect margins, stay compliant, and maintain vendor trust.

3. Strong Support for UAE VAT and Regulatory Requirements

The platform can be configured to handle UAE VAT rules, tax codes, reporting structures, and audit trails. Transactions remain traceable, consistent, and compliant across the system. Finance teams benefit from cleaner VAT reconciliation and structured reporting, reducing last-minute pressure during filing periods and lowering the risk of penalties or mismatches during audits.

4. Cloud-Based Scalability Without Infrastructure Burden

Being cloud-native, Dynamics 365 scales as your business grows. You can add users, entities, locations, or functionality without investing in new servers or IT infrastructure. This is ideal for UAE companies expanding into new Emirates or international markets, as operations can be extended without disrupting existing systems or teams.

5. Automation That Reduces Manual Finance Work

Routine tasks such as invoice posting, bank reconciliation, approvals, inventory updates, and reporting can be automated. This reduces errors and speeds up month-end and year-end close cycles. In the UAE, where skilled finance talent is valuable and time-sensitive reporting is common, automation helps teams focus on analysis and strategy rather than repetitive data entry.

6. Better Control Over Cash Flow and Working Capital

Dynamics 365 helps businesses actively manage receivables, payables, credit limits, and payment cycles. This improves liquidity planning and reduces cash flow surprises. For UAE businesses dealing with long payment cycles or multiple currencies, this control supports healthier cash positions and stronger supplier and customer relationships.

7. Seamless Collaboration Across Teams

The system integrates seamlessly with core Microsoft applications such as Excel, Outlook, Teams, and Power BI, while also connecting with third-party tools like CRM, payroll, and banking platforms. This creates a unified workflow across finance, sales, and operations; particularly valuable for UAE organisations managing multiple systems and multinational teams.

8. Enterprise-Grade Security and Data Governance

Dynamics 365 is designed with security baked into everyday workflows. Granular user roles, multi-factor authentication, approval controls, and continuous audit trails ensure only the right people see or change sensitive data. With encryption, Azure-level identity protection, and real-time activity monitoring, UAE businesses gain stronger control over financial, payroll, and customer data; without adding operational friction.

9. Easy Customisation for Industry-Specific Needs

Dynamics 365’s modular design allows workflows, reports, and approvals to be configured around how businesses actually operate. For example, real estate firms can track property-level income, commissions, and escrow movements; while trading and logistics businesses can align inventory, invoicing, and multi-entity reporting; without rebuilding the system or forcing teams into rigid processes.

10. Advanced Automation Capabilities in Accounting Automation

Dynamics 365 supports end-to-end accounting automation across reconciliations, recurring journals, VAT calculations, and approval workflows. For UAE businesses, this reduces manual effort, improves accuracy, shortens month-end close cycles, and allows finance teams to focus on control, analysis, and informed decision-making rather than routine processing.

Get more value from Microsoft Dynamics with the right accounting partner

Microsoft Dynamics adds real structure and control to finance teams only when it’s set up and governed the right way. In the UAE, that means aligning the system with VAT rules, audit expectations, and region-specific reporting needs. Without disciplined processes and experienced oversight, even powerful tools deliver inconsistent data and delayed insights.

The right accounting partner turns Dynamics into a dependable decision engine. Clean chart of accounts, accurate automation rules, and consistent close processes lead to reliable reporting, sharper forecasts, and better cash flow control. AI-driven features then work as intended, reducing manual effort instead of adding complexity.

Whiz Consulting supports UAE businesses with hands-on Microsoft Dynamics accounting services, from day-to-day bookkeeping and management reporting to compliance and system optimisation. Partner with us to combine practical accounting expertise with automation know-how, so your MS Dynamics investment delivers clarity, efficiency, and confident financial decisions.

Get customized plan that supports your growth

Have questions in mind? Find answers here...

Yes. Dynamics 365 pulls live data from bank feeds, AR/AP, inventory, and expenses into a single view. Cash positions, inflows, outflows, and forecasts update continuously, so finance teams see issues as they form, not after month-end.

It depends on the scope. A standard finance setup typically takes 6–10 weeks. Multi-entity, custom workflows, or legacy migrations can extend timelines. A phased rollout often delivers usable reporting within the first few weeks.

Yes, you can tailor charts of accounts, approval flows, reports, dashboards, and industry-specific logic.

Yes. Dynamics 365 connects to major banks, POS systems, payroll tools, CRMs, and e-commerce platforms via native connectors and APIs. This keeps sales, payroll, and cash data in sync without manual work.

Largely, yes. It supports UAE VAT rates and reporting formats aligned with Federal Tax Authority requirements. Most businesses add a light configuration to match their exact filing and audit needs.

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.