- English

- Arabic

In This Blog Post

Share This Article

- Published: Aug 18, 2025

- Last Updated: Oct 17, 2025

- 🔊 Listen

Quick Reads

- Choosing a top-tier accounting firm in the UAE is crucial for long-term growth and success, as they act as a strategic partner, not just a service provider.

- PwC, Deloitte, EY, KPMG, and BDO are consistently ranked among the top firms in the UAE, offering innovative services and deep industry knowledge.

- These top firms offer comprehensive services, including audit, tax, advisory, risk management, and digital transformation consulting, leveraging global technology platforms.

- Top outsourced accounting firms in UAE, such as MindSpace Outsourcing, Finsmart Accounting, and Whiz Consulting, are known for helping businesses cut costs while maintaining high standards.

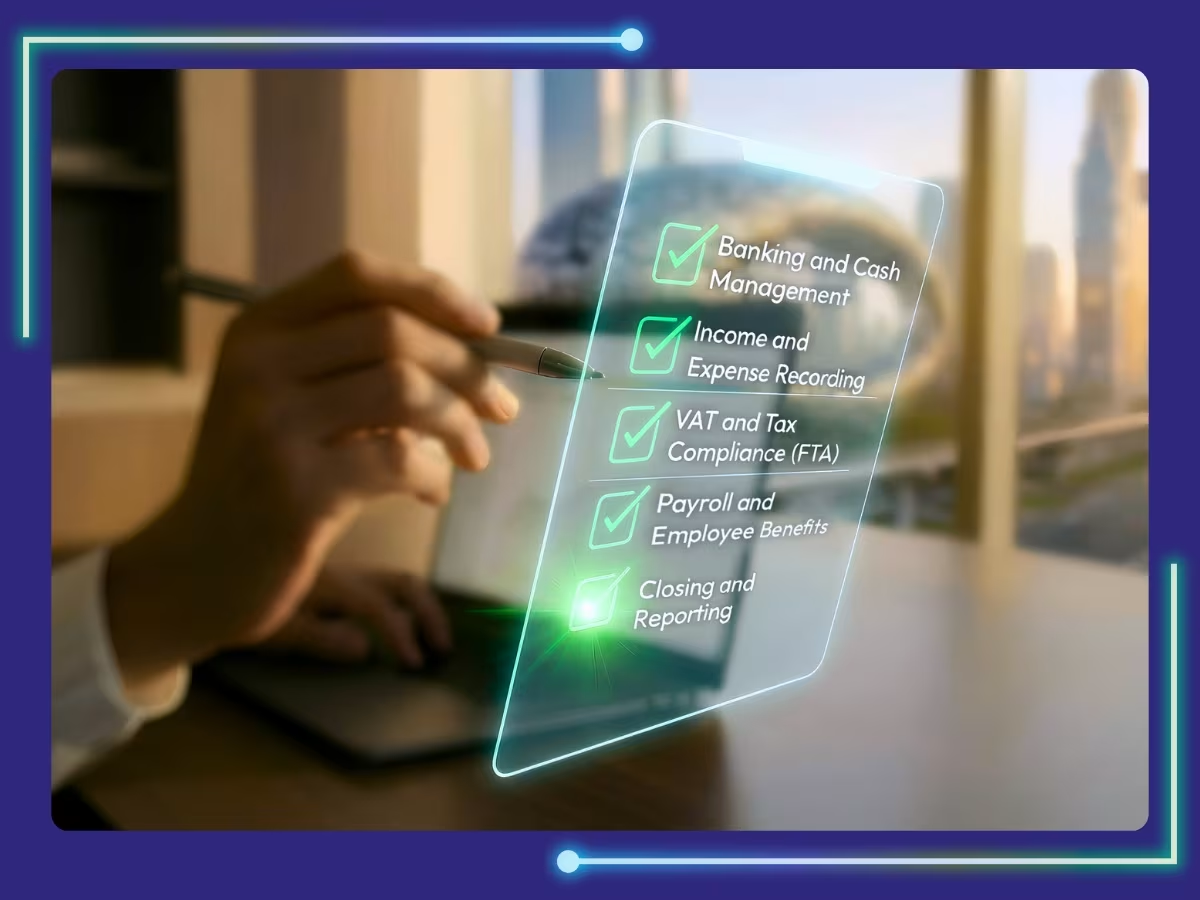

- Outsourcing firms provide end-to-end services like bookkeeping, payroll, tax preparation, and CFO services.

- Ultimately, selecting the right firm, whether a global giant or a specialized outsourcing provider, ensures greater efficiency, accuracy, and peace of mind for your business.

With hundreds of accounting firms in the UAE, the task of finding one that truly fits your business can be overwhelming. The right choice is more than just a name, it is a partner that understands your vision and scales with you. To help you make a well-informed choice, we have compiled a detailed list of the top accounting firms in the UAE. This blog outlines each firm’s strengths, specializations, and client focus, giving you the insight needed to select a trusted partner for long-term growth and success.

Outsourcing Done Right!

Get Streamlined Processes, Expert Support, and Financial Clarity.

Top 10 Accounting Firms in UAE

For UAE businesses seeking reliable expertise, the top accounting firms in UAE, PwC, Deloitte, EY, KPMG, and BDO consistently rise to the top. Here’s a closer look at what they offer, the qualities that distinguish them, and why they continue to be the preferred choice for businesses and professionals.

PwC

PwC has been operating in the Middle East for over 40 years, with a strong presence in the UAE. The firm operates major offices in key UAE cities, including Dubai, Abu Dhabi, and Sharjah, providing a comprehensive range of services such as audit and assurance, advisory, tax, legal, digital consulting, deals, and sustainability strategy.

Deloitte

Deloitte maintains a strong footprint in the UAE with offices in Dubai, Abu Dhabi, Fujairah, Ras Al Khaimah, and Sharjah. The firm offers comprehensive services in audit and assurance, tax, consulting, financial advisory, risk management, and legal support. The firm serves a wide variety of sectors including financial services, real estate, government, construction, and manufacturing.

KPMG

KPMG has been a well-recognized player in the UAE accounting and advisory space since it started its operations in the country in 1973. The firm now employs approximately 1,700 professionals across multiple offices in the UAE. The firm’s core services include audit, tax, and advisory, with strong offerings in ESG consulting, performance improvement, and digital transformation.

EY

EY has a strong presence in the UAE with offices in Dubai, Abu Dhabi, and Sharjah, providing services including assurance, tax, advisory, transaction services, digital transformation, sustainability strategy, and risk management. The firm’s service portfolio includes assurance and audit, tax, advisory, transaction services, digital transformation consulting, sustainability strategy, and risk management.

BDO

BDO established its presence in the UAE in 1969 and employs around 200 to 500 professionals locally. The firm provides a comprehensive range of accounting services including audit, tax, consulting, and business advisory, focusing primarily on mid-market and growing businesses. The firm uses efficient, scalable audit and advisory tools to deliver practical and cost-effective solutions.

Grant Thornton

Grant Thornton UAE was established in 1966 by Farouk Mohamed, the current Chairman. The firm operates from three offices in Dubai, Abu Dhabi, and Sharjah, employing over 200 professionals. They provide a comprehensive range of services including audit and assurance, internal audit, tax advisory, transaction advisory, business outsourcing, and general advisory with a strong focus on small to medium-sized enterprises and high-growth businesses.

RSM UAE

RSM UAE, operating as RSM Dahman Auditors, has been serving clients in the UAE since 1996. With an estimated team size of 100-200 professionals, the firm provides a wide range of services, including audit and assurance, accounting, payroll, risk management, internal audit, business advisory, and outsourcing solutions, with a notable focus on real estate accounting.

Crowe UAE

Crowe UAE was founded in 1981 by Dr. Khalid Maniar and has built a strong presence in the country over four decades. The firm offers audit, tax, advisory, risk management, and technology-driven business solutions to clients across various sectors. They cater to various sectors such as financial services, healthcare, and real estate. Crowe UAE’s strength lies in combining deep local market understanding with global network resources, making it a trusted partner for both local and international businesses.

Emirates Chartered Accountants Group

Established in Dubai in 2005, Emirates Chartered Accountants Group, now part of CLA Global is an ISO 9001:2015 certified firm employing around 200-500 professionals. They provide a comprehensive suite of services, including internal and external audit, IFRS and forensic audit, business advisory, mergers and acquisitions support, accounting, bookkeeping, company setup, corporate and VAT tax services, transfer pricing, and digital transformation solutions such as RPA and ERP implementation.

Farahat & Co.

Farahat & Co. has been operating in Dubai and across the UAE since 1985 with an employee size between 51 and 200 professionals, earning a reputation for reliability and professionalism. The firm offers audit, accounting, bookkeeping, VAT and tax consulting, payroll services, trademark registration, and court expert services for businesses in both mainland and free zone jurisdictions.

Top 10 Accounting Outsourcing Firms in UAE

The UAE has witnessed notable growth in accounting outsourcing services, alongside its well-established homegrown firms. Providers such as MindSpace Outsourcing, Finsmart Accounting, Bazaar Accounting, CDA Audit, Whiz Consulting, AL MERAK, and Bill accouning deliver comprehensive finance and accounting solutions without the need for an in-house team.

Let’s learn more about these firms in detail:

MindSpace Outsourcing

MindSpace Outsourcing has been active in the UAE since approximately 2019, specializing in delivering outsourced bookkeeping, payroll, and tax-preparation services to CPA firms and businesses of all sizes in the region. The firm is known for its flexibility in supporting multiple accounting software platforms, including Peachtree, MYOB, QuickBooks, Sage, and Xero.

Finsmart Accounting

With over 17 years of industry experience, Finsmart has established a strong presence in the UAE market, providing outsourced accounting services. They offer bookkeeping, payroll, tax, and fractional CFO services, powered by their FinsmartAI platform for automatic P&L, cash-flow, KPI, and ratio reporting. Their key strength is tech-agnostic integration they work with QuickBooks, Xero, or whichever system you already use so adoption is seamless and cost-effective.

Bazaar Accounting

Bazaar Accounting & Management Advisors LLC (BAM Advisors), founded in Dubai in 2021, employs between 11 and 50 professionals. The firm provides a full range of services across the UAE, including accounting, VAT, corporate tax, HR and payroll outsourcing, management consulting, company formation, licensing, and visa support.

The firm is proficient in multiple accounting software platforms such as Xero, QuickBooks, and Zoho, enabling tailored solutions to fit client requirements and improve efficiency.

CDA Audit

CDA Audit, officially operating as CDA Accounting & Bookkeeping Services LLC, has been serving businesses in Dubai and across the UAE since 2015. With a team of over 100 professionals, the firm is led by experienced chartered accountants.

Their services cover accounting, bookkeeping, auditing, VAT compliance, payroll, CFO advisory, due diligence, reconciliation, business advisory, and IFRS support. CDA Audit uses advanced accounting software such as QuickBooks, Xero, Zoho Books, and SAP to provide efficient, tailored solutions for compliance and strategic business insights.

Whiz Consulting

With over 10 years in the industry, Whiz Consulting stands out as a reliable partner for businesses seeking precision in accounting and bookkeeping. The firm brings strong expertise in accounts payable and receivable, financial reporting, payroll, and taxation, while leveraging advanced cloud accounting software such as Zoho Books, QuickBooks, NetSuite, and MS Dynamics.

Known for driving innovation in financial workflow technology, Whiz Consulting’s strength lies in its technical capability and consistent, efficient delivery, particularly in managing large-scale finance operations and complex e-commerce environments.

AL MERAK

Based in Dubai, AL MERAK was founded in 2014 and employs between 50 and 249 professionals. The firm supports businesses in the UAE with tax consultancy services, including VAT and corporate tax, accounting, outsourced CFO services, payroll, audit, and regulatory compliance.

AL MERAK also offers comprehensive business set-up solutions such as company formation and insurance support. The firm utilizes modern accounting software and digital tools to deliver efficient and compliant financial services tailored to the UAE market

OBG Outsourcing

OBG Outsourcing, with over 17 years of industry experience, provides expert bookkeeping, tax preparation, payroll, and financial analysis services to businesses and CPA firms in the UAE. The firm employs certified professionals and supports a wide range of accounting tools including QuickBooks, Xero, Sage, and MYOB.

OBG offers scalable, flexible solutions, delivering year-round or peak-season support. Their advanced technology, reliable infrastructure, and cost-efficient approach make them a trusted partner for UAE businesses seeking technology-driven financial management.

Valucent Consultancy

Valucent Consultancy provides accounting, audit, tax, corporate finance, and advisory services to UAE and international clients. They use cloud platforms like Xero, QuickBooks or Sage for seamless, secure bookkeeping and compliance across jurisdictions.

As a member of Antea International, Valucent offers clients access to expertise in 70 countries. Their key value lies in tailored, high-quality advisory and financial solutions that blend global reach with a client-focused approach.

Bill Accounting

Bill Accounting is one of the top 10 accounting outsourcing firms in the UAE, specializing in outsourced bookkeeping, accounting, payroll, taxation, and financial analysis services. The firm employs experienced professionals and leverages cloud-based platforms like QuickBooks, Xero, and MYOB to deliver secure and customized financial reporting.

Bill Accounting offers competitive pricing without compromising quality, enabling UAE businesses to efficiently manage compliance and optimize their financial operations with technology-enabled solutions.

Kreston Global

Kreston Menon, the UAE representative firm of Kreston Global, has been operating since 1994. Over the years, it has expanded into a leading professional services firm with more than 350 specialists working across nine offices in major UAE cities such as Dubai, Abu Dhabi, Sharjah, and Ras Al Khaimah.

The firm delivers an extensive suite of services that spans audit, tax, outsourcing, payroll, and advisory, alongside business consulting, corporate finance, governance, and risk management.

How to Choose the Right Outsourced Accounting Company?

Selecting the right accounting firm in the UAE involves weighing several key considerations. Experience, software proficiency, sector-specific knowledge, and pricing alignment all play a crucial role in finding the ideal partner. Here is a comprehensive guide that outlines the essential points you should review to make a well-informed choice.

- Define Your Business Needs: Do decide what to outsource, full-cycle accounting or specific areas like bookkeeping, AP/AR, payroll, or reporting.

- Look for Relevant Qualification: Pick firms with CAs, CPAs, or ACCAs. Ensure they understand UAE VAT, 2023 corporate tax, and your sector’s regulations.

- Assess Experience in Your Industry: Ask for case studies or client references from businesses similar to yours. Relevant experience cuts onboarding time and avoids compliance errors.

- Technology and Software: Choose a partner that is proficient in widely used accounting software such as Zoho Books, QuickBooks, Xero, Sage, or Oracle NetSuite, and ensure they can integrate with your POS, ERP, or e-commerce platforms.

- Pricing Structure: Clarify whether the provider offers fixed monthly retainers, hourly rates, or project-based pricing. Ask about additional charges for urgent requests, VAT audit support, or system integration.

- Communication and Accessibility: Look for providers who offer a dedicated account manager and regular reporting schedules weekly, monthly, or quarterly. Ensure they use secure communication channels such as Microsoft Teams, Slack, or Zoom.

Achieve Peace of Mind with End-to-End Accounting Expertise

Selecting the right accounting firm can transform how your business runs. The right partner boosts efficiency, ensures accuracy, and gives you the peace of mind that your finances are in safe hands. You might lean toward the global reach and reputation of Deloitte, PwC, EY, KPMG, or BDO.

Or you may prefer the outsourced approach, a personalized, technology-driven model adopted by firms like Mindspace Outsourcing, Bazaar Accounting, or Whiz Consulting. These firms specialize in outsourced accounting services that combine automation, expert oversight, and flexibility to streamline your financial operations. Either way, these firms deliver finance and accounting services designed to fit your unique needs and business goals.

Get customized plan that supports your growth

Have questions in mind? Find answers here...

Top accounting firms in the UAE typically offer a range of services, including bookkeeping, financial reporting, accounts receivable or payable management, payroll management and advisory services.

Leading accounting firms in the UAE serve various industries, including real estate, construction, retail, hospitality, healthcare, and manufacturing, among others.

Yes, many accounting firms in the UAE offer remote or virtual accounting solutions, allowing businesses to access their services online for greater convenience and flexibility.

Yes, tax planning and compliance are key services provided by top accounting firms in the UAE. They assist businesses in managing tax obligations, ensuring compliance with local regulations.

Yes, UAE accounting firms offer advisory services that help businesses plan and implement growth and expansion strategies, including financial forecasting, budgeting, and market analysis.

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.